A secured loan signifies that the borrower has set up some asset like a method of collateral prior to getting granted a loan. The lender is issued a lien, that's a suitable to possession of house belonging to another man or woman till a financial debt is paid. In other words, defaulting on a secured loan will provide the loan issuer the authorized power to seize the asset that was set up as collateral.

Own loans guideGetting a private loanPayday Loan AlternativesManaging a private loanPersonal loan reviewsCompare major lendersPre-qualify for a personal loanPersonal loan calculator

Unsecured loans usually element higher interest rates, lessen borrowing limits, and shorter repayment phrases than secured loans. Lenders might at times need a co-signer (a one that agrees to pay for a borrower's personal debt whenever they default) for unsecured loans if the lender deems the borrower as risky.

Very best IRA accountsBest on the web brokers for tradingBest on the internet brokers for beginnersBest robo-advisorsBest solutions investing brokers and platformsBest trading platforms for working day buying and selling

Look at our dwelling shopping for hubGet pre-approved for any mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs buy calculatorHow A lot am i able to borrow property finance loan calculatorInspections and appraisalsMortgage lender reviews

Once you are matched which has a lender, and also your loan is approved, the curiosity fees and costs that you're going to incur throughout repayment will be delivered to you.

Nevertheless, this doesn't affect our evaluations. Our opinions are our personal. Here is a list of our associates and here's how we earn a living.

Lenders make use of your Social Security selection to confirm your identity. Entering a legitimate amount is important, as unverifiable details will lead to rejection. What is going to my SSN be utilized for?

Refinancing and equity guideToday's refinance ratesBest refinance lenders30-year fastened refinance rates15-year fixed refinance ratesBest cash-out refinance lendersBest HELOC Lenders

Best credit history cardsBest reward offer you credit score cardsBest equilibrium transfer credit cardsBest journey credit score cardsBest income back credit history cardsBest 0% APR credit score cardsBest benefits credit rating cardsBest airline credit cardsBest school student credit rating cardsBest bank cards for groceries

Refinancing and equity guideToday's refinance ratesBest refinance lenders30-calendar year set refinance rates15-12 months mounted refinance ratesBest income-out refinance lendersBest HELOC Lenders

Broaden your request to incorporate more fiscal possibilities that specialise in consolidating more info unsecured personal debt.

At the time permitted by a lender, your money are deposited right into your account once the next business enterprise day. We are in this article in your case

Enter your interest price. Your personal loan desire charge is predicated totally on your credit rating profile and fiscal data. Very good-credit score borrowers with reduced debt-to-income ratios normally get the lowest premiums.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Brandy Then & Now!

Brandy Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Richard Thomas Then & Now!

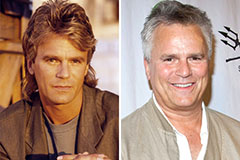

Richard Thomas Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!